Do banks grant mortgages for properties without a first occupancy license or cédula de habitabilidad?

Buying a property in Spain without a first occupancy licence or a cédula de habitabilidad is possible in certain situations, but it involves significant risks, especially if mortgage financing is required. This is a common source of confusion for many buyers, particularly international ones, who may not be familiar with how these documents affect a purchase.

The key point is understanding that being able to buy a property is not the same as being able to mortgage it or legally live in it. Below, we explain what happens when these documents are missing and how this impacts mortgage approval in Spain.

What is the cédula de habitabilidad and what is it used for?

The cédula de habitabilidad is the document that certifies that a property meets the minimum legal requirements to be used as a dwelling. While the exact criteria vary by autonomous community, it generally confirms:

-

a minimum usable surface area,

-

adequate ceiling heights,

-

the existence of a kitchen and bathroom,

-

proper ventilation and natural light,

-

compliant doors and windows,

-

basic hot water supply,

-

and minimum safety standards.

The inspection is carried out by a registered architect or technical architect.

The cost is usually low (often under €200) and the document typically has a validity of around 15 years, after which it must be renewed if the property is sold or rented, depending on regional regulations.

Is the cédula de habitabilidad mandatory to buy a property?

From a strictly legal standpoint, it is not always mandatory to complete a purchase, but the absence of a cédula of habitability can seriously complicate matters.

Without it:

-

you cannot register as a resident (padrón),

-

it may be impossible to connect or transfer utilities (water, electricity or gas),

-

home insurance companies may refuse to provide cover,

-

and most importantly, the property is usually not eligible for a residential mortgage.

For this reason, although the sale itself may go through, the risk for the buyer is considerable.

Do banks grant mortgages without a cédula de habitabilidad?

As a general rule, no.

Spanish banks only grant residential mortgages on properties that are officially recognised as habitable.

If a property lacks a cédula de habitabilidad or a first occupancy licence, banks consider that it does not meet the minimum legal requirements to be used as a home and therefore cannot be accepted as mortgage collateral.

In very specific cases, the only alternatives may be:

-

a loan for a commercial property or non-residential use,

-

or a self-builder / developer loan.

These products usually come with shorter repayment terms and higher interest rates, making them unsuitable for most residential buyers.

What if the property also lacks a first occupancy license?

This situation is even more problematic.

The first occupancy licence is issued by the local council and certifies that the building has been completed in accordance with the approved project and may legally be used as a residence.

If a property has never been granted this licence:

-

it is considered not legally authorised for residential use,

-

registering a mortgage at the Land Registry is usually impossible,

-

utility connections are generally denied,

-

and the buyer cannot register as a resident.

In areas such as the Costa Blanca and the Costa Cálida, this issue can occasionally arise in older properties, undeclared refurbishments or buildings with urban planning irregularities.

Can you buy a property without a cédula de habitabilidad?

Yes, but these transactions usually involve:

-

properties classed as “out of planning order”,

-

homes with unresolved urban planning issues,

-

or older buildings that have never been regularised.

In such cases, the mortgage valuation is significantly affected. The appraisal value is often well below the market price and, as a result, the bank will not approve a mortgage.

Mortgage valuers always assess the legal and urban planning status of the property. If there are irregularities, the risk is transferred directly to the buyer.

What happens if I buy a property without these documents?

The buyer assumes full responsibility.

If they decide to keep the property, they must usually:

-

undertake the legalisation process (if it is possible),

-

cover the technical and administrative costs involved,

-

or accept that the property cannot legally be used as a residence.

In some cases, regularisation is not possible at all, which is why proper due diligence before signing is essential.

Differences between the first occupancy license and the cédula de habitabilidad

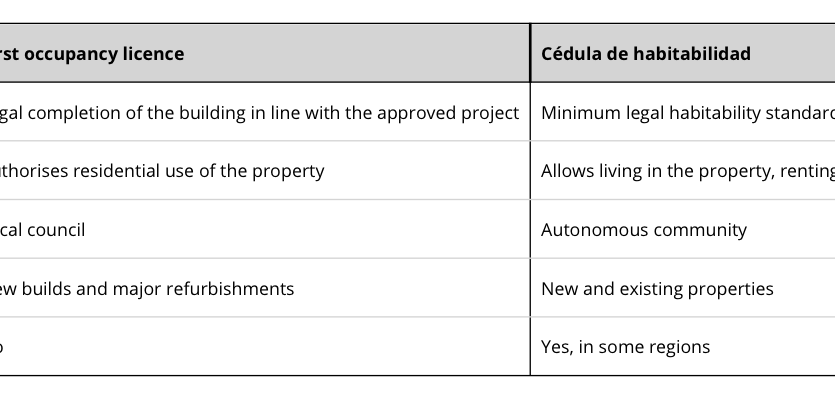

| Feature | First occupancy licence | Cédula de habitabilidad |

|---|---|---|

| What does it certify? | Legal compliance of the build with the approved project. | Minimum legal habitability requirements. |

| What is it used for? | Authorises the property to be used as a dwelling. | Allows living in the property and connecting utilities (in many cases). |

| Issued by | Local council (town hall). | Autonomous community (regional authority). |

| Applies to | New builds and major refurbishments. | New and existing properties. |

| Does it need renewal? | No. | Yes, in some regions. |

Conclusion

Buying a property without a first occupancy licence or a cédula de habitabilidad may seem attractive in some cases, but it involves serious legal, financial and practical risks, especially when mortgage financing is needed.

Before committing to a purchase, it is essential to review the legal and urban planning status of the property. Early checks can prevent major problems later on.

At Esentya Estate, we help international buyers purchase property safely on the Costa Blanca and the Costa Cálida, carefully verifying documentation and guiding them through every step of the process.

Sources: regional housing regulations, banking practice, mortgage valuation criteria, Idealista